Podcast: Play in new window | Download

In this episode of the Option Plus podcast, I am discussing the power of contrarian thinking and its relationship to Bitcoin. I recently gave a speech to participants in an economics Olympiad, urging them to think outside the box and embrace alternative options.

It surprised me to find that many young people I spoke to were conservative in their thinking, as I believe that the youth should be open to experimentation and new ideas. To illustrate the benefits of contrarian thinking, I share examples from financial markets and hiring practices.

In order to truly stand out and achieve world-class expertise in a particular field, I believe that it is necessary to combine multiple areas of expertise. This is called your unique ability.

To ignite contrarian thinking, I follow the questioning approach of Peter Thiel: He encourages his employees and potential hires to consider what they believe to be true about the world that most people would disagree with.

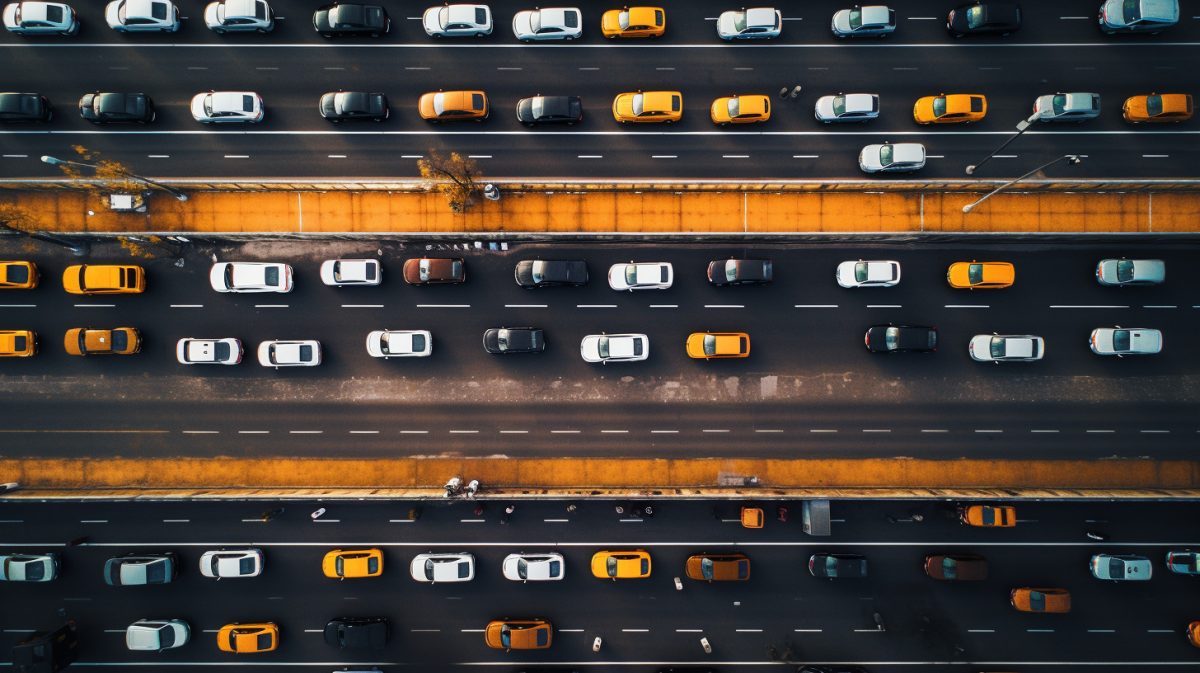

One of my own contrarian thoughts revolves around the concept of parallel societies and parallel financial markets. Having witnessed the growth of the internet and understanding its inner workings due to my presence during its development, I believe that a new parallel financial system is emerging through Bitcoin.

Despite the common perception that Bitcoin is small and not widely used, it actually has a substantial user base and is more widely adopted than many realize. However, the decentralized nature of Bitcoin makes it challenging to measure its impact using traditional methods. I recommend individuals to explore this field and avoid relying solely on macroeconomics – it’s snake oil science.

Failure is integral to improvement, and those who succeed in the long run are those who have an advantage – an edge. Stability is a myth, and embracing volatility can actually reduce stress. Prices serve as an information system that reflects the interplay between supply and demand. It is better to prepare for and embrace the volatile nature of the world.

Links: